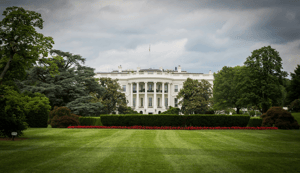

As President Biden settles into his new role as President of the United States, you may be wondering how the federal estate tax may be affected.

As President Biden settles into his new role as President of the United States, you may be wondering how the federal estate tax may be affected.

During the campaign, Biden pledged to roll back many of President Trump’s tax policies. In response to the Tax Cuts and Jobs Act (TCJA), Biden has promised a progressive approach to taxation, focused primarily on increasing the burden on high-income individuals and businesses.

So what does this mean for you?

Proposals for gift and estate taxes

The TCJA reduced estate taxes by cutting the top rate from 55% to 40% and temporarily doubling the federal gift and estate tax exemption to $10 million (adjusted annually for inflation), through 2025. The 2020 exemption is $11.58 million for individuals and $23.16 million for married couples; for 2021, it’s $11.7 million and $23.4 million, respectively. These TCJA amounts are scheduled to expire after 2025 to $5 million for individuals and $10 million for married couples, adjusted annually for inflation.

Biden has proposed reducing the exemption to $3.5 million for estate taxes and exempting $1 million for the gift tax. He also favors imposing a top estate tax rate of 45%, from the current rate of 40%.

In addition, Biden would like to end the “step-up” in basis that spares beneficiaries substantial tax liability for capital gains on inherited assets that have appreciated in value, such as stock or a house. Specifically, if a beneficiary sells an inherited asset now, the capital gains tax is based on the asset’s fair market value at the time of the inheritance, rather than the date of the original purchase.

Review your estate plan

In light of these changes, it is worth your while to review your estate plan and make any necessary revisions. Potential tax law changes are a reason to trigger a review, as well as life changes, such as a marriage, the birth of a child or a divorce. We are here to help with reviewing your plan and making changes based on your specific circumstances. © 2021