By: Howard Coleman, Chief Investment Officer and General Counsel Coldstream wealth management

The economy is in a constant cycle. With ebbs and flows, highs and lows, we can be sure that things are always in motion. This month, we caught up with Howard Coleman, Chief Investment Officer and General Counsel for Coldstream Wealth Management in Bellevue, to get his take on where we are in the economic cycle, and where things are headed.

Last year’s economic climate was characterized by the phrase “synchronized global growth.” Economic activity throughout the world accelerated, and, as a result, equity markets rallied globally. By contrast, this year we have seen significant divergence between US equity markets and most other equity markets globally, as the chart below indicates:

Source: Bloomberg

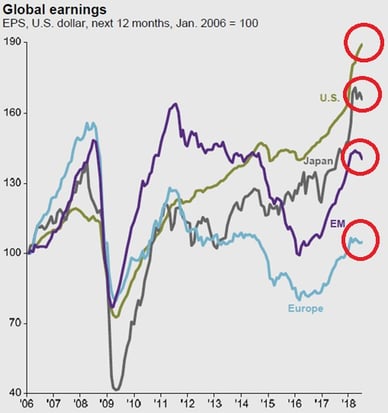

This divergence is primarily due to differences in corporate profitability. After-tax profits for US corporations rose 16.1% in the second quarter, according to the Commerce Department, the largest increase in six years. This compares favorably to corporate profitability outside the US. As you can see from the chart below, US corporate profitability has risen sharply in 2018 while corporate profitability in the rest of the world has been flat or down.

Source: JP Morgan

Increased US corporate profitability has come from both the effects of corporate tax reform and a growing US economy, which posted a 4.2% gain in GDP in the second quarter. While the effects of tax reform should fade over time, US leading economic indicators (LEIs) remain very positive. Historically, when LEIs turn negative, the US economy will typically go into a recession, after a time lag. In almost all circumstances, the US economy does not go into a recession while LEIs remain positive, and bear markets rarely occur outside of a recession.

Some commentators argue that we are “due” for a recession, but recessions don’t happen in a vacuum. We do not currently see any signs of a recession, and while the market may correct from its current run, there is currently no bear market in sight.

Two elements of the “wall of worry” could potentially change this outlook. First, the Fed is now tightening monetary policy through raising rates and unwinding its balance sheet from its QE experiment. If the Fed tightens too aggressively, the tightening could have a material impact on US growth. The Fed is conscious of this danger, but it is in unchartered waters as it has never before had to unwind a balance sheet this large.

The second element is a potential all-out trade war with China. This, too, could affect the US economy by not only slowing growth but also increasing inflationary pressures. We already have seen significant increases in steel and washing machine prices, two items affected by tariffs.

To conclude, absent a significant trade war or overtightening, we do not see an imminent end to the current US expansion. While the US equity markets may well temporarily correct, we do not see a bear market in the near future.

Howard Coleman is the Chief Investment Officer and General Counsel at Coldstream Wealth Management in Bellevue, Washington. Coldstream Wealth Management is an independent firm offering comprehensive financial planning and customized investment portfolios for high net-worth individuals, families, and organizations.Coldstream guides clients through the complexity of wealth management so that they can have peace of mind while achieving their financial and lifestyle goals.He can be reached at 425-283-1600 and through e-mail at Howard.Coleman@coldstream.com