Last year was another hot year in crypto. Whether you were crypto curious and bought some ETH on Coinbase or you’ve been HOLDing since 2017 and finally harvested some of those gains, we’re seeing more of our clients get into cryptocurrency than ever before. For those who just bought and haven’t sold any yet, your reporting requirements may be minimal or none. But for everyone else, this is my PSA on crypto taxation and what to share with your CPA.

Last year was another hot year in crypto. Whether you were crypto curious and bought some ETH on Coinbase or you’ve been HOLDing since 2017 and finally harvested some of those gains, we’re seeing more of our clients get into cryptocurrency than ever before. For those who just bought and haven’t sold any yet, your reporting requirements may be minimal or none. But for everyone else, this is my PSA on crypto taxation and what to share with your CPA.

Should I report my crypto?

During busy season, I order the same lunch at the same location everyday – they know my name and my order and it’s efficient. Last week the waiter teased that he hasn’t seen me since October and when I explained I’m a tax guy and it’s busy season he asked me, “Hey so I bought $8,000 of Shiba Inu coin because my friends were doing it and then it hit $92,000 and I sold it, but now I’m scared about taxes. My friends say they’re not going to report it and I don’t know what to do or how to handle it. Should I report it on my taxes?” I said, “Congratulations and yes. Without hesitation.”

His question perfectly summed up what I’ve heard from so many others:

- “I’ve made a lot of money, so I must owe a lot of taxes.”

- “I know a lot of other people who plan to hide and not report their crypto.”

- “Even if I want to report it, it’s confusing and I don’t know how to figure it out.”

It is clear that the IRS has been staffing up, hiring industry leading consultants, building up databases of crypto users, and arming themselves for a campaign against crypto non-reporters. Back in 2019, they sent out “courtesy notices” essentially letting people they already identified as crypto holders know that the IRS had their eye on them to make sure they report their crypto.

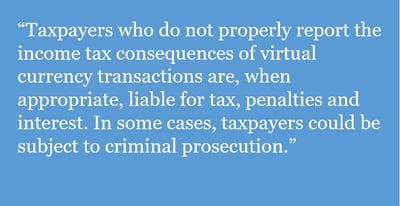

My advice is don’t hide it. Do your best to make a “good faith effort” to report it and consult with your CPA. According to the IRS:

What should I give my CPA to report my crypto?

It depends. But the more involved you are in crypto, more info may be needed. Here is a rough list of the items your CPA would want to know (If you answer “yes” to #1, then #2-3 is all we need for the majority of our clients who have crypto):

- Did you have any cryptocurrency during 2021?

- At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency?

- Form 8949 report for capital gains

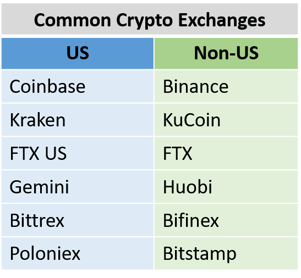

- Did you use any non-US exchanges or wallets? If so, plan to provide the highest value of accounts/wallets during the calendar year.

- Did you sell any NFTs long-term?

- Income and expenses from mining

- Income from staking

- Details on any gifts, donations, or purchases made with crypto

- Did you receive or use cryptocurrency in any business activities?

How do I calculate my crypto gains?

Without going into depth about the rules on cost basis methods, unless you had fewer than a dozen trades you should consider using software to track your gains. I recently was testing out TaxBit, which seems promising, but I thought their tax guide was a great read for anyone with cryptocurrency. You can check that out here.

If, after reading this guide and the steps below you feel like this is a lot of work, well, you’re right. But that’s the cost of doing business outside of highly regulated centralized finance.

Based on feedback from clients or others, the below software providers should get the job done for most crypto situations. Each one offers the ability to connect directly with the most common exchanges and wallets to automatically import transactions and match buys and sells.

Unfortunately, I wouldn’t trust anything to be “plug and done.” So here’s a few additional steps to consider, to help ensure accuracy of the information you’re passing off to your CPA.

- Step 1 – Completeness Is the information imported into the software complete? Do you see transactions going back to when you first started in crypto? Are any accounts or wallets missing? DeFi transactions, incompatible wallets, or lack of transaction history availability are the most common issues that I see come up.

- Step 2 – Character Classification Or in other words “classify use of the asset.” Beyond capital gains from trading or investing, is income from mining or staking correctly separated and identified? Did you receive any airdrops/hard forks? Did you have any long-term capital gains from selling NFTs that need to be separately identified as “collectibles”? Did you gift, donate, buy anything with, or receive any crypto?

- Step 3 – Calculation Do a gut check and do the gains and income calculated by the software make sense? If my waiter friend mentioned earlier generated a report showing $20,000 of long-term capital gains, he should question where’s the other $64k of gains he thought he realized and did he really hold SHIB for 12 months? Were there still lots of coins held at year-end? Is the software recognizing wallet transfers as sales instead of transfers?

I would add that I think any CPA would say it’s about getting “close enough” and is probably OK to be a little off. Your CPA can help you calibrate what is “close enough.” At the end of the day, if the IRS can come up with a more accurate number (good luck) then I think most of us would be inclined to accept it. This is about making a good faith effort and doing your best.

1099-Bs Starting 2023

Recently passed legislation will require cryptocurrency exchanges to issue a 1099-B to report gains and losses beginning with the 2023 tax year, similar to stock brokerages. At that time, not reporting crypto gains would likely result in an automatic under-reporter notice. But another reason to start using software now is your basis info will likely not automatically show up in those reports or it might not be calculated correctly. I expect a lot of 1099-Bs will show only the sales proceeds and not the cost basis of older coins. So tracking your cost basis with software may help justify and substantiate reporting a smaller gain and paying less in tax.

What about FBAR and reporting of non-US crypto assets?

FinCEN is expected to release proposed rules governing reporting of cryptocurrency held on non-US accounts, but until then they’re technically not reportable. I encourage my clients to play it safe and report the non-US account anyway on FBAR and Form 8938, since these forms don’t increase their tax liability. Most exchanges don’t provide monthly statements and backing into the “highest account value” is nearly impossible when there’s multiple trades and various crypto assets all fluctuating in value throughout the year. But for now, I ask my clients to provide a list of accounts and wallets they used during the year and at least a ball park guess of what they think the highest value was. Hopefully when FinCEN comes out with new rules there will be guidance about how to determine highest value when there’s a lack of historical records.

Can the IRS tax my crypto if it’s still in my wallet?

Yes, they can. “But the IRS doesn’t tax my IRA when it increases in value or when a company pays a dividend in stock, so how could they tax my crypto if it’s still in my crypto wallet?” There are many different “tax deferred” examples, but unfortunately they fall under specific sections of the tax code that don’t broadly apply to crypto. A crypto wallet isn’t a tax deferred account or tax exempt entity, unlike an IRA or 401(k), although it’s possible to hold crypto inside your retirement account. Payment of dividends in stocks is taxable in some situations.

But before you complain about the current tax system unfairly taxing crypto, just know that this “taxation without liquidity” problem extends in many instances beyond cryptocurrency. Employees who exercise Incentive Stock Options (ISOs) at a private company, estate taxes on large real estate portfolios, minority members in LLCs that pass-through income without distributing cash, selling over-leveraged real estate received as a gift from parents, and overseas income or gains denominated in a foreign currency are just a few examples of events that can result in U.S. taxes despite having liquidity to pay for those taxes. It’s possible that those promoting the idea that the IRS “can’t tax crypto in wallets” just have never had to deal with some of these other complex tax events. So take it with a grain of salt.

Tax Planning Strategies

For any complex tax situation, you should let your CPA know well in advance what’s going on and start tax planning early.

- Use software to track your gains and cost basis. Imagine a restaurant owner never using bookkeeping software. Actually, I can’t – that would be ridiculous. Your time is valuable and so is timely knowledge of what’s going on with your crypto.

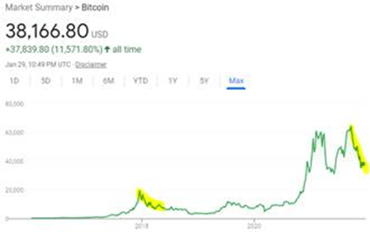

- When you have gains from selling or income from staking or mining, you should budget for those taxes and consider selling to USD. I knew people who had significant gains in December 2017, but when it came to pay their taxes in April 2018 the value had dropped so much they were stuck with a tax bill they could not pay. As the crypto market cools off right now, it’s repeating the same cycle as in 2017 (see image of BTC price history). Your CPA can help by calculating both Safe Harbor and actual quarterly tax estimates.

- Before year-end, consider harvesting tax losses to help offset capital gains during the year. Keep in mind, there’s a current proposal in Congress to subject cryptocurrency, futures, and forex to wash sale loss rules, so I suggest consulting your CPA.

- Trade cryptocurrency in a self-directed IRA to defer taxes and minimize reporting complexities. However, self-directed IRAs and 401(k)s are highly complex and subject to lots of rules and can be compared to graduating a kid from training wheels to a Ducati. Be sure to work with a specialist to make sure it’s right for you and help with all the compliance.

- Donate long-term appreciated crypto assets to qualified charities to avoid capital gains taxes and get an itemized deduction. For Washington residents, ask your CPA about whether donating to a WA-based charity would also help offset WA long-term capital gains taxes.

- Qualified Opportunity Zone Funds can also be used to rollover and defer gains from cryptocurrency.

Ultimately, my advice is be smart, talk with your CPA, and rather than gamble with the IRS you should bet on crypto. Questions? Don't hesitate to reach out to your Sweeney Conrad professional, of contact me using the button below.

Additional resources:

- IRS has begun sending letters to virtual currency owners advising them to pay back taxes, file amended returns; part of agency's larger efforts

- How the Infrastructure Bill is Brewing a Crypto Tax Compliance Nightmare

- Report of Foreign Bank and Financial Accounts (FBAR) Filing Requirement for Virtual Currency

- Treasury to Wrap Crypto Anti-Money Laundering Rules by Fall