In 2016, the Financial Accounting Standards Board (FASB) issued ASU No. 2016-13, Financial Instruments – Credit Losses (FASB ASC 326), Measurement of Credit Losses on Financial Instruments. The standard replaces the incurred loss impairment methodology in current U.S. GAAP with a methodology that reflects expected credit losses on instruments within its scope, including trade receivables; the current expected credit loss (CECL) model. In addition, this standard modifies the impairment model for available-for-sale (AFS) debt securities. The new standard is intended to result in more timely recognition of expected credit losses and therefore provide more useful information to financial statement users.

In 2016, the Financial Accounting Standards Board (FASB) issued ASU No. 2016-13, Financial Instruments – Credit Losses (FASB ASC 326), Measurement of Credit Losses on Financial Instruments. The standard replaces the incurred loss impairment methodology in current U.S. GAAP with a methodology that reflects expected credit losses on instruments within its scope, including trade receivables; the current expected credit loss (CECL) model. In addition, this standard modifies the impairment model for available-for-sale (AFS) debt securities. The new standard is intended to result in more timely recognition of expected credit losses and therefore provide more useful information to financial statement users.

This standard is effective for annual reporting periods beginning after December 15, 2022. These changes are required to be implemented with a cumulative-effect adjustment to beginning retained earnings in the period of adoption, with one exception. If an other-than-temporary impairment has been recognized for an available-for-sale debt security, the new guidance should be implemented prospectively.

The following is intended to provide you with a high-level understanding of the CECL model and the impairment model applicable to AFS debt securities in order for you to begin the process of evaluating how they may impact your recognition of credit losses.

Current Expected Credit Loss (CECL) model:

Prior to the effective date of FASB ASC 326, the measurement of credit losses was based on an incurred loss methodology which delayed the recognition of a credit loss until it was probable that a loss had been incurred. The incurred loss methodology was often applied to a single financial asset (for example, trade receivables from Company A) and focused on historical experience and current conditions when determining if a loss was probable. The CECL model expands the information entities are required to consider when estimating credit losses and lowers the threshold for recognition of losses. The CECL model requires you to pool financial assets that share similar risk characteristics and measure expected credit losses based on historical experience, current conditions, and reasonable and supportable forecasts.

Scope

The CECL model applies to the following assets:

- Financial assets measured at amortized cost, including:

- Trade receivables

- Financing receivables (notes receivable, loans)

- Held-to-maturity debt securities

- Related party notes and receivables (excluding those between entities under common control)

- Contract assets

- Net investments in leases recorded by lessors (sales-type and direct financing leases)

- Off-balance sheet credit exposures, including financial guarantees

The CECL model is not applicable to the following assets:

- Financial assets measured at fair value through net income

- Available-for-sale debt securities

- Loans made to participants by defined contribution employee benefit plans

- Promises to give (pledges receivable) of a not-for-profit entity

- Loans and receivables between entities under common control

- Operating lease receivables accounted for in accordance with FASB ASC 842

- Deferred tax assets

- Inventory

Note that other financial instruments that are either subject to or not subject to CECL may not be included in the listings above.

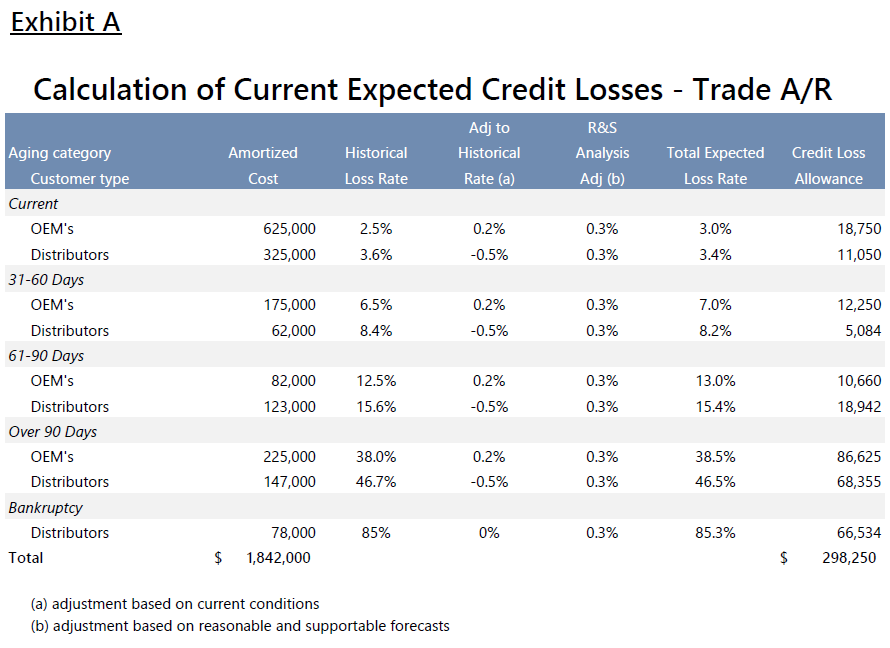

CECL approach

Step 1 – Form pools of financial assets that share similar risk characteristics

FASB ASC 326-20-32-2 requires a reporting entity to measure expected credit losses on a collective (pool) basis when similar risk characteristics exist. If a financial instrument does not share similar risk characteristics with other assets, expected credit losses may be measured on an individual asset basis.

Examples of risk characteristics that, individually or in combination, could be considered when pooling assets include:

- Internal or external credit ratings

- Date of origination

- Aging category

- Industry

- Geographic location

- Financial asset type

- Collateral type

- Size

- Effective interest rate

- Term

- Payment structure

Note: Pools are not static and should be reassessed each reporting period.

Step 2- Estimate losses over the contractual life of the financial assets

FASB ASC 326-20-30-3 does not prescribe the use of a specific method to calculate the allowance for credit losses. Methods that may be used include discounted cash flows, loss rate, roll rate, probability-of-default, aging schedule, or weighted-average remaining maturity (WARM).

The selection of a model to estimate the allowance for credit losses will depend on the reporting entity’s facts and circumstances, including the complexity and significance of the financial instruments being evaluated, as well as other relevant considerations. No matter the model selected, it is required to take into account historical experience, current conditions, and reasonable and supportable forecasts.

If an entity’s quantitative models and historical data do not reflect current conditions or an entity’s reasonable and supportable forecasts, such factors should be included through qualitative adjustments in order for the estimate in total to be reasonable.

A reporting entity may begin the process of measuring expected credit losses by analyzing its historical loss experience for financial assets with risk characteristics similar to the assets being measured. However, this information must be adjusted to reflect the extent to which management expects current conditions and reasonable and supportable forecasts to differ from the conditions that existed for the period over which historical information was evaluated and due to differences in the makeup of the pool.

To adjust historical credit loss information for current conditions and reasonable and supportable forecasts, an entity should consider significant factors that are relevant to determining the expected collectability. Examples of factors an entity may consider include any of the following, depending on the nature of the asset:

- Unemployment rates

- Sources of income available to the borrower

- Collateral valuations

- Payment status or payment structure

- Regulatory and legal environment

- Local and macro-economic conditions

- Business and market segment conditions

Developing reasonable and supportable forecasts over the entire contractual term may not be possible. FASB ASC 326-20 state that an entity should revert to unadjusted historical loss information for that remaining period.

See Exhibit A for an example of a model that could be used to estimate the allowance for credit losses for trade receivables.

Step 3- Report an allowance for expected losses

The allowance should include both the estimated loss as well as expected recoveries of amounts previously written-off. The inclusion of estimated recoveries can result in a “negative allowance” on an individual financial asset or a pool of financial assets whereby the allowance is added to the amortized cost basis of a financial asset to present the net amount expected to be collected.

Step 4 – Convert loss allowances into write-offs, in accordance with company policies

An entity is required to write-off individual financial assets (or a portion of the asset) in the period in which a determination is made that the financial asset is uncollectible. In general, this occurs when all reasonable means of recovering the outstanding balance have been exhausted.

Other items of note:

No loss expected – The CECL model requires an entity to estimate and record an allowance for credit losses for a financial instrument, even when the expected risk of credit loss is remote. However, FASB ASC 326-20-30-10 does not require an entity to measure expected credit losses on an instrument, or a pool of instruments, if historical information adjusted for current conditions and reasonable and supportable forecasts results in zero expected credit losses. FASB ASC 326-20-55-49 refers to U.S. Treasuries as an example of an asset that may result in an expectation that the risk of non-payment is zero given that they are guaranteed by a high-quality sovereign entity with a long history of no credit losses. This example sets a high bar for concluding that zero expected credit losses is reasonable and therefore these situations are not expected to occur frequently.

Entities will need to apply judgment and consider the specific facts and circumstances to determine if a zero-loss estimate is supportable. An entity will need to support that it expects the non-payment of the instruments’ amortized cost basis to be zero, even if the borrower defaults.

Normally, corporate bonds would not qualify for zero expected credit losses because even highly rated bonds have some risk of loss, regardless of the specific borrower having no history or expectation of default and nonpayment.

Term of financial instrument – Under FASB ASC 326-20, a reporting entity estimates expected credit losses over the life of the financial instrument at each reporting period. The life over which an entity should estimate expected credit losses should consider prepayments, but not expected extensions, renewals, or modifications unless the extension or renewal options are explicitly stated in the contract and are not unconditionally under the control of the lender.

Subsequent events and the allowance for credit losses – Events or transactions related to the estimate for credit losses that occur after the balance sheet date but before the financial statements are issued (or available to be issued) can be either recognized or nonrecognized subsequent events.

In applying the subsequent event guidance, an entity should first consider if the information received indicates a weakness or deficiency in the credit loss estimation process. If so, the information received subsequent to the balance sheet date but before the financial statements are issued (or available to be issued) should be considered in the credit loss estimate. If the information is clearly and directly attributable to an event that occurred subsequent to the balance sheet date, this would be considered a non-recognized subsequent event as it does not provide additional evidence about conditions that existed at the balance sheet date. An entity should not adjust its year-end credit loss estimate, instead it should determine if the non-recognized subsequent event is required to be disclosed.

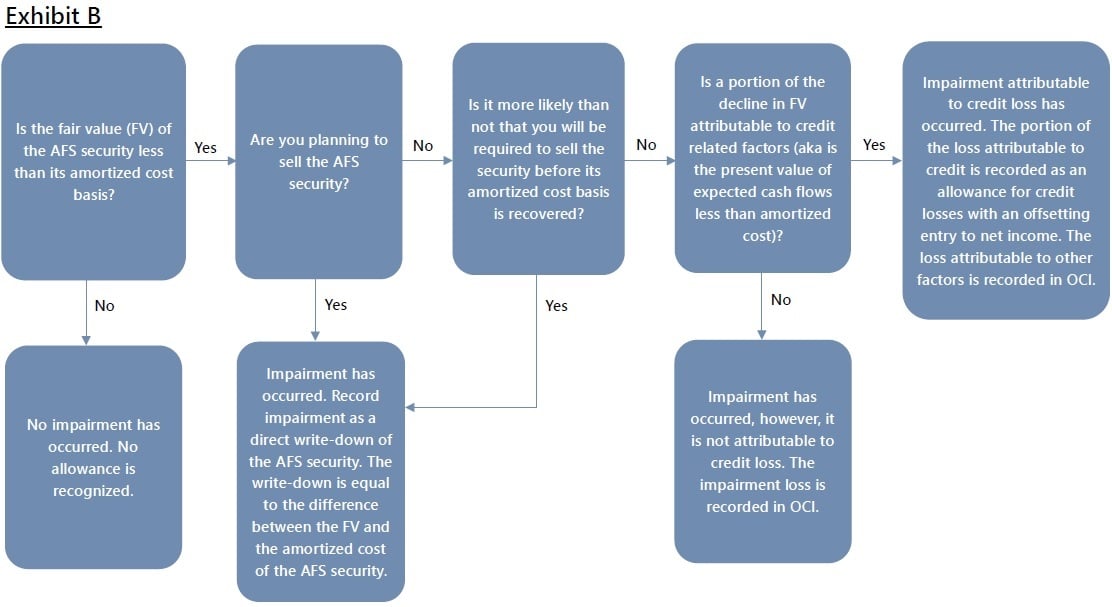

Impairment model for Available-for-Sale Debt Securities:

Prior to the effective date of FASB ASC 326, declines in the fair value of available-for-sale debt securities below amortized cost were assessed based on whether they were other-than-temporary. Determination of whether a credit loss existed took into account the length of time that fair value was below amortized cost, historical and implied fair value volatility, and fair value changes after the balance sheet date. Other-than-temporary impairment was recognized through a direct write-off of the asset.

Upon the effective date of FASB ASC 326, the concept of other-than-temporary impairment was removed. Determination of whether a credit loss exists no longer takes into account the length of time that fair value is below amortized cost, and it does not require the consideration of historical and implied fair value volatility and fair value changes after the balance sheet date. An available-for-sale debt security whose fair value is below amortized cost is considered impaired. Impairment attributable to credit loss is recognized through an allowance account rather than a direct write-off. Impairment due to other factors is recognized through other comprehensive income.

FASB ASC 326-30-55-1 through 326-30-55-4 discusses some of the factors to be considered when determining whether a credit loss exists, including:

- The extent to which fair value is less than amortized cost basis,

- adverse conditions specifically related to the security, and industry, or geographic area (for example, changes in the financial condition of the issuer),

- changes in the quality of the security’s credit enhancement,

- the payment structure of the security,

- changes in the security’s rating,

- failure of the issuer to make scheduled principal or interest payments on the security,

- remaining payment terms of the security,

- prepayment speeds,

- the issuers financial condition, and

- the value of any underlying collateral.

In order to determine the amount of impairment attributable to credit loss, an entity should compare the present value of the cash flows expected to be collected on the available-for-sale debt security with the security’s amortized cost basis. If the present value of cash flows expected to be collected is less than the security’s amortized cost basis, a credit-related impairment exists, and the difference should be recorded as an allowance for credit losses through net income.

See Exhibit B for an overview of the AFS debt security impairment model.

If you are interested in obtaining additional information on FASB ASC 326 or would like to further discuss the impacts this new standard may have on your organization, please contact us at your convenience.