Last week, President Trump signed the Families First Coronavirus Response Act, to provide relief for families amidst the global COVID-19 outbreak. The Act will be effective on April 2nd and as an employer, there are things you should consider for business planning and compliance in this evolving situation.

The Emergency Paid Sick Leave Act and The Emergency Family and Medical Leave Expansion Act are two provisions under this new response that will most likely the most immediate impact on employers.

The Emergency Paid Sick Leave Act (EPSLA)

Key Takeaways:

- Paid sick leave for workers

- Employers receive 100% reimbursement for paid leave pursuant to the Act in the form of a tax credit.

- Health insurance costs are also included in the credit

- Employers face no payroll tax liability

- Self-employed individuals receive an equivalent credit

- Reimbursement will be quick and easy to obtain by an immediate dollar-for-dollar tax offset against payroll taxes. Where a refund is owed, the IRS will issue a refund check.

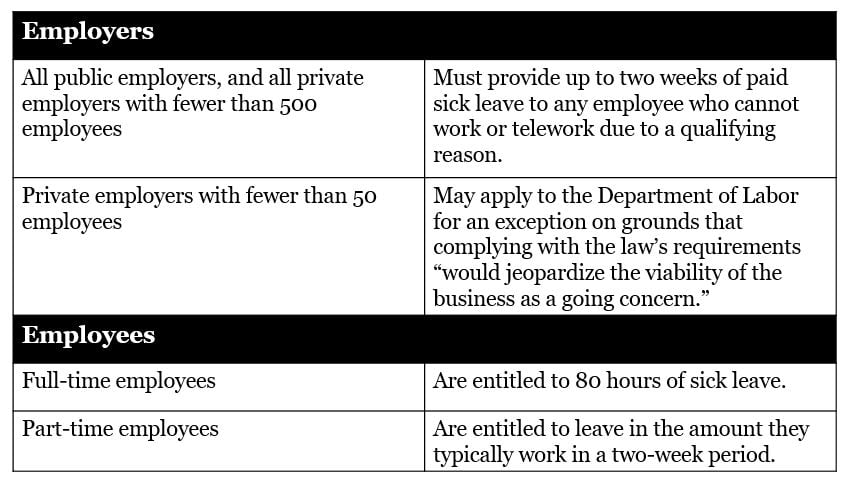

Under the EPSLA:

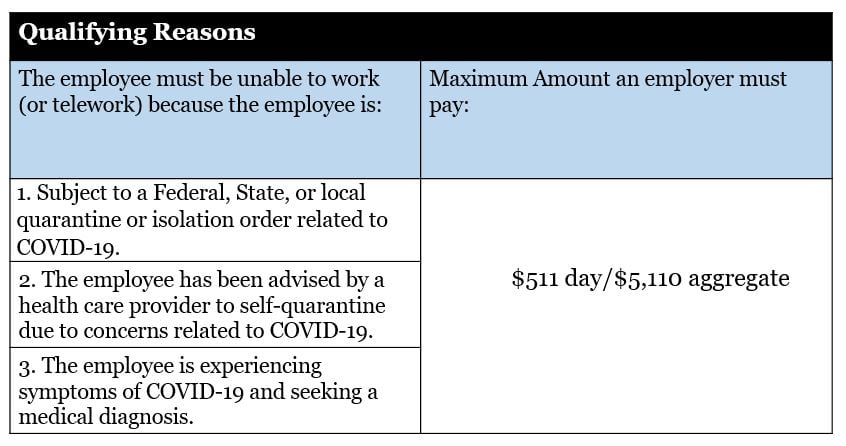

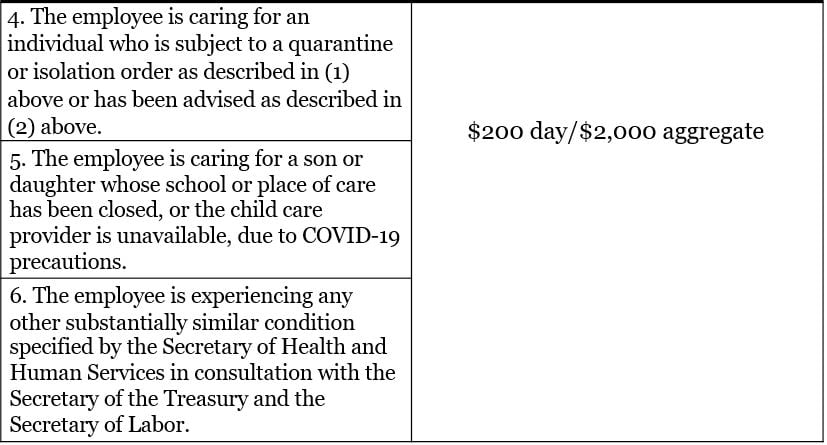

There are six ways to qualify for expanded family and medical leave, and a maximum amount, you, as an employer must pay.

Emergency Paid Sick Leave will expire on December 31, 2020, and unpaid leave does not carry over into 2021. There is no right or entitlement for unused leave to be paid to employees on separation from employment.

Additional Sick Leave Policies

In addition to leave covered under the EPSLA, employers must continue to provide all sick leave benefits to which employees may be entitled under company policies that are in existence by the effective date of the Law.

The Act allows an employee to first use their available EPSLA benefits prior to using any other sick leave benefits to which they may be entitled. As an employer, you may not require your employee to use other paid leave provided by your company before their EPSLA, though they may choose to do so.

Employer Notice Requirements

As a covered employer, you are required to post in conspicuous places on the premises a notice of the Act in the workplace. The notice can be found here.

Tax Credit

The Act provides a tax credit equal to the $511/day and $200/day maximum amounts. The tax credit will be claimed against your portion of Social Security taxes. Any amount that an employer overpays will be repaid by the federal government like a tax refund.

The Emergency Family and Medical Leave Expansion Act (EFMLEA)

Key Takeaways:

- Up to 10 weeks of paid sick leave for workers

- Amends the Family Medical Leave Act to incorporate a public health emergency and childcare coverage

- As with the EPSLA, these changes apply to public employers and private employers with fewer than 500 employees.

- Under the new provisions, employees who have worked for an employer for at least 30 days are eligible for up to 12 weeks of job-protected leave.

The Breakdown

The first two weeks of this leave will be unpaid. This is designed to overlap with the EPSLA. The following 10 weeks will be paid. As an employer, you must pay the employee at a rate of no less than 2/3 of the employee’s usual rate of pay, capped at $200 per day and $10,000 total.

Job Restoration

Employees’ rights are similar as the rights under the regular FMLA. However, employers with fewer than 25 employees may deny restoration to the same or a similar job if the employee’s position does not exist after FMLA leave due to economic conditions or other changes in operating conditions of the employer that are caused by a public health emergency, during the period of the leave.

Small Employer Exemption

The Act requires the Department of Labor to write regulations that will allow employers with fewer than 50 employees to be exempt if “complying with the law’s requirements would jeopardize the viability of the business as a going concern.” The Department of Labor has not announced the conditions of such exemptions but should be shortly.

Tax Credit

The Act provides a tax credit equal to the $511/day and $200/day maximum amounts. The tax credit will be claimed against your portion of Social Security taxes. Any amount that an employer overpays will be repaid by the federal government like a tax refund.

We encourage you to visit our COVID-19 Resource page for updates as it relates to this ever-evolving situation. Please contact your Sweeney Conrad professional to learn more about how these changes will affect your business, and for help on claiming your tax credit.