On January 12, a final Department of Labor (DOL) rule went into effect that amends the regulations governing the selection of retirement plan investments by fiduciaries under ERISA. Some important changes were made to the Final Rule from the proposed rule that was first issued a year ago.

On January 12, a final Department of Labor (DOL) rule went into effect that amends the regulations governing the selection of retirement plan investments by fiduciaries under ERISA. Some important changes were made to the Final Rule from the proposed rule that was first issued a year ago.

In particular, the Final Rule eliminated specific references to environmental, social and governance (ESG) or ESG-themed funds. The DOL acknowledged the fluid definition of ESG factors and concluded that “the lack of a precise or generally accepted definition of ‘ESG,’ either collectively or separately as ‘E, S, and G,’ made ESG terminology not appropriate as a regulatory standard.”

Eliminating ESG Terminology

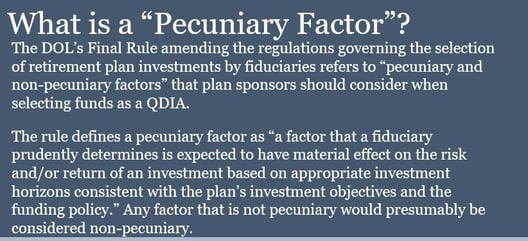

The Final Rule does retain the proposed rule’s prohibition of the use of ESG funds as a qualified default investment alternatives QDIA, but it does so without using ESG terminology. Instead, it refers to “pecuniary and non-pecuniary factors” when defining relevant fiduciary investment duties.

Specifically, the rule states that a fund cannot be used as a QDIA “if its investment objectives or goals or principal investment strategies include, consider or indicate the use of one or more non-pecuniary factors.” Clearly, the DOL believes that if a fund’s objectives include non-pecuniary goals, the fund should not be the default investment alternative — even if the fund was selected on the basis of objective risk-return criteria.

According to the DOL, this prohibition is intended to help ensure that participants’ financial interests remain paramount by removing non-pecuniary considerations if their retirement savings are being automatically invested through a QDIA.

Determining the Use of Pecuniary Factors

The question, of course, is how can plan sponsors determine whether or not a fund’s objectives, goals or strategies use non-pecuniary factors? According to the DOL, you should be able to determine this by reviewing a fund’s prospectus.

But this determination may still be open to interpretation and subjectivity. If there’s any reference in the fund’s objectives or strategies to ESG goals or screening criteria — such as exclusion of investments in companies that produce or distribute alcohol or tobacco — you will have to determine whether goals or criteria are based on pecuniary or non-pecuniary factors.

The DOL has stated that if no non-pecuniary factors are reflected in a fund’s objectives or principal strategies, it can be selected as a QDIA. This makes it critical to review a fund’s objectives and principal strategies as communicated in the prospectus carefully before deciding whether to select it as a QDIA.

Note: If the fund is a fund of funds, you’ll need to review the prospectuses of all underlying funds as well.

Minimize Your Risk

At this early stage, it’s still unclear whether ESG factors affect the risk and/or return of an investment. The DOL has acknowledged that ESG factors could be considered pecuniary in certain circumstances. However, it has cautioned plan sponsors against concluding too hastily that ESG funds may be selected as QDIAs based on pecuniary factors.

In short: If you choose a fund whose objectives or strategies involve ESG goals or screening as your plan’s QDIA, there could be a risk that the fund is not a permissible QDIA under the DOL Final Rule.

You have until April 30, 2022, to make any necessary changes to your plan to comply with the Final Rule’s requirements related to the selection of QDIAs.

We are here to answer your questions on the DOL Final Rule, including the selection of ESG funds as QDIAs.