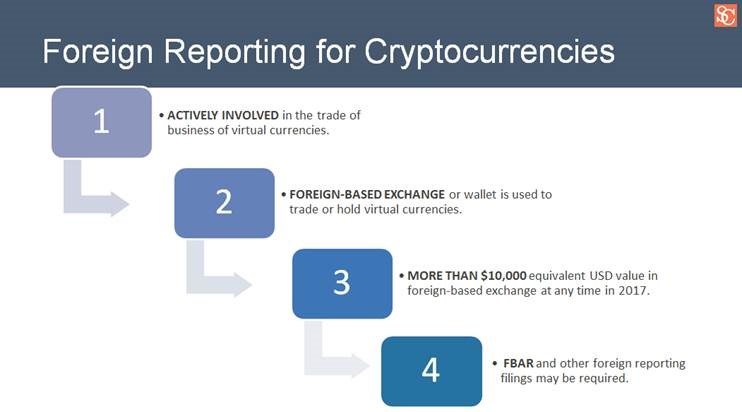

You know your cryptocurrency trades are reportable, you’ve got your Coinbase report in hand, and you’re bracing yourself to find out how much tax you’ll owe on your 2017 Bitcoin gains. But are you forgetting something? Depending on how involved you are in cryptocurrencies, you may also need to file an information report with your return for any coins held in overseas accounts.

While FinCen issued guidance back in 2013 stating that “users” aren’t subject to foreign reporting, note that “exchangers” are.

Most holders and investors of virtual currencies fall under the “user” category and don’t need to worry. But if you are in the trade or business of virtual currencies you may qualify as an “exchanger” subject to foreign reporting requirements.

Exchangers would include anyone who:

- actively trades cryptocurrencies (we’re talking hundreds of hours making hundreds of trades),

- is in the business of mining cryptocurrencies,

- organizers of an ICO, or

- anyone who trades or invests cryptocurrencies on behalf of someone else (such as an investment pool).

The guidance refers to existing rules used to determine if day traders and commodities traders qualify as a “trader in securities or commodities” for tax purposes.

If a taxpayer qualifies as an exchanger, then they would likely be subject to foreign reporting for any virtual currencies held or traded in an exchange or virtual wallet that is based outside the US that exceeded an equivalent value of $10,000 USD at any time during the year.

For example, a trader in cryptocurrencies who had $15,000 worth of Bitcoin with Bitfinex (based in Hong Kong) would need to file for FBAR.

A taxpayer materially participating in mining cryptocurrencies that holds $800,000 in GDAX (US) and $200,00 in Shapeshift (Switzerland) would file FBAR and Form 8938 for the amount in Shapeshift.

The rules are complex. The IRS has not released clear guidance on this, but we want to make sure we take a conservative approach and do the right thing for our clients.

Some of the biggest and most common virtual currency exchanges with a base of operations outside the US include:

- Bitfinex

- Coinone

- Binance

- Cryptopia

- Shapeshift

However, taxpayers and CPAs should pay close attention as exchanges seek new bases of operations when a home country creates an unfriendly regulatory environment (e.g. China banning exchanges).

You should consult with your CPA to know whether you’re subject to foreign reporting and what information you should provide. This is still a very uncertain area of the law and the potential risk of misreporting is substantial.